A Smart Tool for Bear Market Investing

Overview:

The Value Capture Index (VCI) is a new and simple way to measure how well you’ve invested during a market dip. Created by Jaideep Banerjee, founder of Magnaspire Ventures, the VCI helps investors know whether they’ve made the most of a falling market by timing their average buying effectively.

Why Do We Need VCI?

During bear markets, prices fall and emotions run high. Investors often buy in too early or too late. The VCI brings clarity. It tells you how efficiently you’ve bought shares during a downturn, so you’re not guessing whether your average buy price is strong or weak.

The VCI Formula Let’s break it down:

Component 1:

(Recent All-Time High — Recent Bottom Price) × Number of Shares Held

Component 2:

(Recent All-Time High — Your Average Buy Price) × Number of Shares Held

VCI = Component 2 ÷ Component 1

This formula gives a value between 0 and 1.

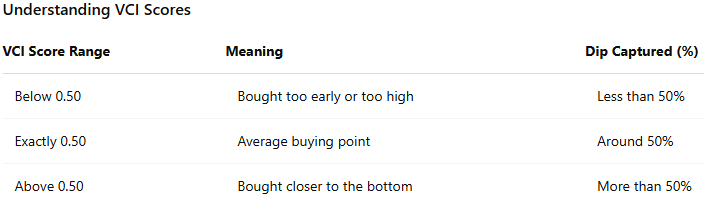

A VCI score above 0.50 means your average entry was closer to the market bottom than the top — showing better timing and decision-making.

When Should You Use VCI?

- To judge the quality of your buying during a dip

- To decide if you should invest more

- To backtest your past bear market entries

- To compare performance across assets

Dynamic vs Historical Use

- Live/Dynamic VCI: Use current prices to make ongoing decisions.

- Historical VCI: Analyze how you performed during past market crashes.

What Makes VCI Unique? Unlike dollar-cost averaging, which spreads your buys over time blindly, VCI tells you if you’re buying smartly in relation to the market’s actual drop. It rewards patience and planning — not panic.

How to Improve Your VCI

- Avoid buying heavily at or near market highs.

- Keep funds ready for deeper market dips.

- Use technical indicators and macro insights to spot strong buy zones.

- Don’t average down without clear strategy.

Conclusion:

The Value Capture Index (VCI) is more than just a formula — it’s a mindset for smarter investing. It turns bear markets from fear-inducing to opportunity-filled. Whether you’re a retail trader or a fund manager, VCI brings clarity and discipline into your investment process.

Inventor’s Note & Ownership:

This metric was developed by Jaideep Banerjee, and all rights to the concept, formula, and naming belong to him. The VCI is a core intellectual property under Magnaspire Ventures, a research-driven initiative dedicated to advancing financial strategy and investor success.

.png)

.jpg)

.jpg)

.jpg)

0 Comments